Hey there, future financial guru! Ready to embark on a journey to financial freedom (peace of mind)? Buckle up, because we’re about to dive into the world of financial discipline and sacrifice. Don’t worry, we’ll keep it light, fun, and full of laughs. Let’s get started!

Why A Financially Disciplined Mind Leads To Peace

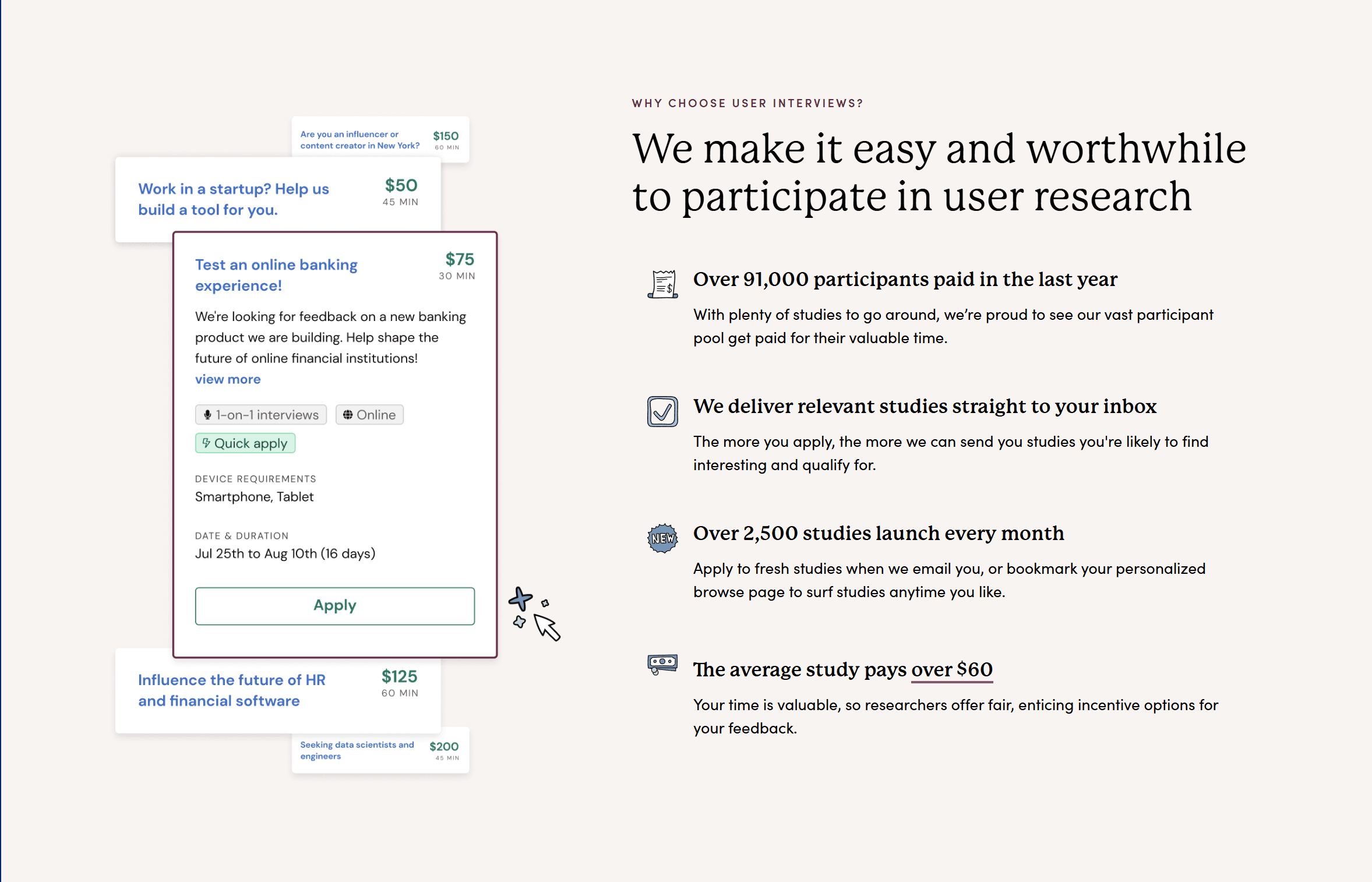

Imagine financial discipline as that friend who always has their life together. You know, the one who packs a lunch instead of ordering takeout every day. Sure, it might seem a bit boring at first, but trust me, this friend has some serious perks.

1. Peace of Mind

Ever had that sinking feeling when you check your bank account after a weekend of “treating yourself”? Financial discipline helps you avoid those heart-stopping moments. By keeping track of your spending and saving regularly, you’ll always know where your money is going. No more financial surprises!

2. Achieving Goals

Want to buy a house? Travel the world? Retire early? Financial discipline is your ticket to achieving these dreams. By setting a budget and sticking to it, you’ll be able to save for those big-ticket items without breaking a sweat.

3. Freedom

Ironically, financial discipline actually gives you more freedom. When you’re not constantly worried about money, you can focus on the things you love. Plus, having a financial cushion means you’re prepared for whatever life throws your way.

The Art of Sacrifice: It’s Not as Bad as It Sounds

Okay, I know what you’re thinking. “Sacrifice? That sounds awful!” But hear me out. Sacrifice doesn’t mean giving up everything you love. It’s about making smart choices that benefit you in the long run. And guess what? It can even be fun!

1. The Latte Factor

Let’s talk about the infamous latte factor. Sure, that daily coffee run is tempting, but those $5 lattes add up! By making your coffee at home, you could save hundreds of dollars a year. Plus, you get to experiment with fancy coffee recipes. Win-win!

2. DIY Entertainment

Who needs expensive nights out when you can have just as much fun at home? Host a game night, have a movie marathon, or try out a new recipe with friends. You’ll save money and create lasting memories.

3. Thrift Shopping

Channel your inner fashionista and hit up thrift stores. Not only will you find unique pieces, but you’ll also save a ton of money. Plus, it’s eco-friendly. Talk about a triple win!

Tips for Staying on Track (Maintaining a peace of mindset)

Now that you’re pumped about financial discipline and sacrifice, let’s talk about how to stay on track. Here are some tips to keep you motivated:

1. Set Clear Goals

Having clear, achievable goals will keep you focused. Whether it’s saving for a vacation or paying off debt, knowing what you’re working towards makes it easier to stay disciplined.

2. Reward Yourself

Yes, you heard that right. Reward yourself! When you hit a financial milestone, treat yourself to something special. Just make sure it’s within your budget.

3. Find a Buddy

Everything’s more fun with a friend, right? Find a financial buddy to share your journey with. You can motivate each other, share tips, and celebrate your successes together.

Conclusion

Financial discipline and sacrifice might sound daunting, but with the right mindset, they can be empowering and even enjoyable. Remember, it’s all about making smart choices that benefit you in the long run. So go ahead, embrace your inner financial guru, and watch your dreams come true. It’s time to achieve peace of mind. You’ve got this!

Wealth can be very simple

I use WealthSimple for all my investments because it’s the most user-friendly and intuitive investing app for beginners & advanced investors alike. It offers commission-free trading & cash accounts with an awesome 2.25% – 3.25% interest rate.

But most importantly, it feels truly human.

$25 free with code:

3JNWOG