Welcome to the wonderful world of financial responsibility! Whether you’re just starting out on your financial journey or looking to brush up on the basics, this guide is here to help. We’ll walk through everything from budgeting to saving, and even investing. Let’s dive in!

1. Understanding Your Income

Before you can manage your money, you need to know how much you have coming in. Your income is the money you earn from your job, side hustles, or any other sources. Here’s how to get a clear picture:

Example:

- Salary: If you earn $3,000 per month after taxes, that’s your take-home pay.

- Side Hustles: Maybe you tutor students on weekends and make an extra $200 per month.

- Other Income: Perhaps you receive $100 monthly from a rental property.

- Total Monthly Income: $3,300

2. Creating a Budget

A budget is your financial roadmap. It helps you track where your money goes and ensures you’re not spending more than you earn. Here’s how to create one:

Steps to Create a Budget:

- List Your Income: Start with your total monthly income.

- Track Your Expenses: Write down all your monthly expenses. This includes rent, utilities, groceries, transportation, entertainment, and any other regular costs.

- Categorize Expenses: Group your expenses into categories like housing, food, transportation, etc.

- Set Spending Limits: Allocate a specific amount of money to each category based on your income and priorities.

Example:

- Income: $3,300

- Expenses:

- Rent: $1,000

- Utilities: $150

- Groceries: $300

- Transportation: $200

- Entertainment: $150

- Savings: $500

- Miscellaneous: $200

- Total Expenses: $2,500

- Remaining Balance: $800 (This can be saved, invested, or used for unexpected expenses.)

3. Saving Money

Saving money is crucial for financial security. It helps you handle emergencies and achieve long-term goals. Here are some tips:

Tips for Saving Money:

- Pay Yourself First: Treat savings like a non-negotiable expense. Set aside a portion of your income as soon as you get paid.

- Automate Savings: Set up automatic transfers to your savings account.

- Cut Unnecessary Expenses: Identify and eliminate non-essential spending.

Example:

If you save $500 per month, in one year, you’ll have $6,000 saved up. This can be your emergency fund or go towards a big purchase like a vacation or a new gadget.

4. Managing Debt

Debt can be a major obstacle to financial freedom. Here’s how to manage it effectively:

Steps to Manage Debt:

- List Your Debts: Write down all your debts, including credit cards, student loans, and any other loans.

- Understand Interest Rates: Know the interest rates on each debt. Focus on paying off high-interest debt first.

- Create a Repayment Plan: Allocate a portion of your budget to debt repayment. Consider using methods like the snowball or avalanche method.

Example:

- Credit Card Debt: $4,000 at 18% interest

- Student Loan: $12,500 at 5% interest

- Focus on paying off the credit card debt first because it has a higher interest rate. Once that’s paid off, direct those payments towards the student loan.

5. Building Credit

Good credit is essential for securing loans and getting favorable interest rates. Here’s how to build and maintain good credit:

Tips for Building Credit:

- Pay Bills on Time: Late payments can negatively impact your credit score.

- Keep Credit Utilization Low: Use less than 30% of your available credit.

- Monitor Your Credit Report: Check your credit report regularly for errors and discrepancies.

Example:

If you have a credit card with a $1,000 limit, try to keep your balance below $300 to maintain a good credit utilization ratio.

6. Investing for the Future

Investing helps your money grow over time. Here’s a beginner’s guide to investing:

Types of Investments:

- Stocks: Buying shares of a company.

- Bonds: Lending money to a company or government.

- Mutual Funds: Pooling money with other investors to buy a diversified portfolio of stocks and bonds.

- Real Estate: Buying property to rent out or sell for a profit.

Example:

If you invest $5,000 in a mutual fund with an average annual return of 8%, in 10 years, your investment could grow to approximately $10,794.62 (that’s $5,794.62 of interest earned).

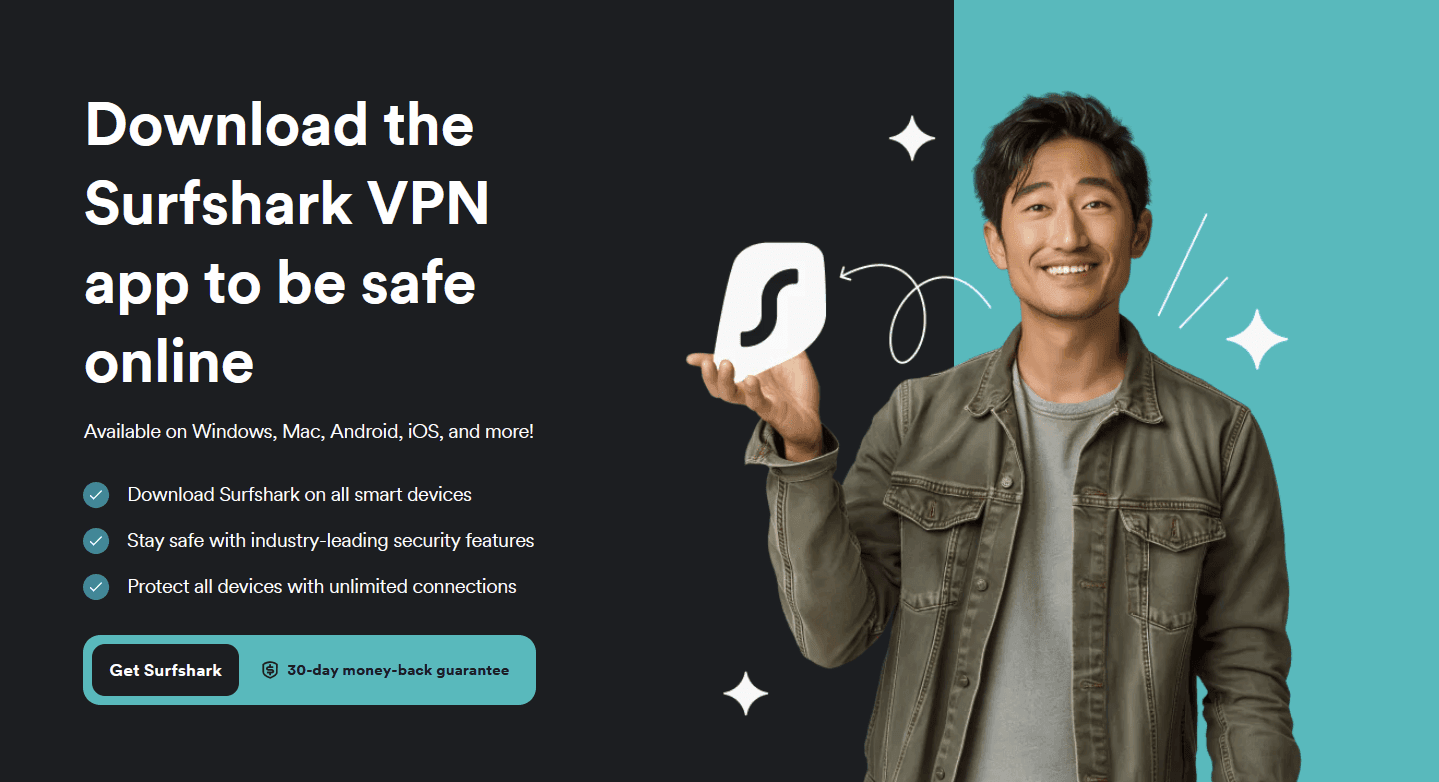

Wealth can be very simple

I use WealthSimple for all my investments because it’s the most user-friendly and intuitive investing app for beginners & advanced investors alike. It offers commission-free trading & cash accounts with an awesome 2.25% – 3.25% interest rate.

But most importantly, it feels truly human.

$25 free with code:

3JNWOG

7. Planning for Retirement

It’s never too early to start planning for retirement. Here’s how to get started:

Steps to Plan for Retirement:

- Set Retirement Goals: Determine how much money you’ll need to retire comfortably.

- Choose Retirement Accounts: Consider accounts like 401(k)s, IRAs, or Roth IRAs.

- Contribute Regularly: Make regular contributions to your retirement accounts.

Example:

If you contribute $200 per month to a retirement account with an average annual return of 6%, in 30 years, you could have around $200,000 saved for retirement.

Conclusion

Financial responsibility is a journey, not a destination. By understanding your income, creating a budget, saving money, managing debt, building credit, investing, and planning for retirement, you’re setting yourself up for a secure financial future. Remember, it’s okay to start small and gradually build your financial knowledge and habits. Happy saving!