Investing can often seem intimidating, especially with the constant ups and downs of the stock market. But what if there was a strategy that could help you navigate these fluctuations with ease? Enter Dollar Cost Averaging (DCA) – a simple yet powerful investment strategy that can make your financial journey smoother and more rewarding. In this guide, we’ll explore the benefits of Dollar Cost Averaging with detailed examples, all in a friendly and approachable tone.

What is Dollar Cost Averaging?

Dollar Cost Averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the market conditions. This means you buy more shares when prices are low and fewer shares when prices are high. Over time, this approach can help reduce the impact of market volatility and lower the average cost of your investments.

The Benefits of Dollar Cost Averaging

1. Reduces the Impact of Market Volatility

One of the biggest advantages of Dollar Cost Averaging is that it helps mitigate the effects of market volatility. By investing consistently over time, you avoid the risk of making a large investment at the wrong time. Instead, you spread your investments across different market conditions, which can lead to a more stable and predictable investment journey.

Example:

Imagine you decide to invest $500 every month in a particular stock. In January, the stock price is $50, so you buy 10 shares. In February, the price drops to $40, allowing you to buy 12.5 shares. By March, the price rises to $60, and you purchase 8.33 shares. Over three months, you’ve bought a total of 30.83 shares at an average price of $48.65 per share, rather than the $50 you would have paid if you invested all $1500 at once in January.

2. Encourages Consistent Investing

Dollar Cost Averaging promotes a disciplined investment habit. By committing to invest a fixed amount regularly, you make investing a part of your routine. This consistency can be particularly beneficial for long-term financial goals, such as retirement savings or building a college fund.

Example:

Let’s say you set up an automatic investment plan to contribute $200 to your retirement account every month. Over the course of a year, you’ll have invested $2400 without having to think about it. This steady approach ensures that you’re continuously building your investment portfolio, regardless of market conditions.

3. Reduces Emotional Investing

Emotional investing can lead to poor decision-making, such as panic selling during market downturns or buying impulsively during market highs. Dollar Cost Averaging helps take emotions out of the equation by sticking to a predetermined investment schedule. This can lead to more rational and objective investment decisions.

Example:

During a market downturn, many investors might feel the urge to sell their investments to avoid further losses. However, with Dollar Cost Averaging, you continue to invest your fixed amount, buying more shares at lower prices. When the market eventually recovers, you’ll benefit from having accumulated more shares at a lower cost.

4. Simplifies the Investment Process

Dollar Cost Averaging simplifies the investment process by eliminating the need to time the market. You don’t have to worry about predicting market highs and lows or constantly monitoring stock prices. Instead, you can focus on your long-term financial goals and let the strategy work for you.

Example:

Consider an investor who wants to invest in a diversified portfolio of mutual funds. By setting up a Dollar Cost Averaging plan, they can automatically invest a fixed amount in their chosen funds every month. This approach eliminates the need to research and time individual investments, making the process straightforward and stress-free.

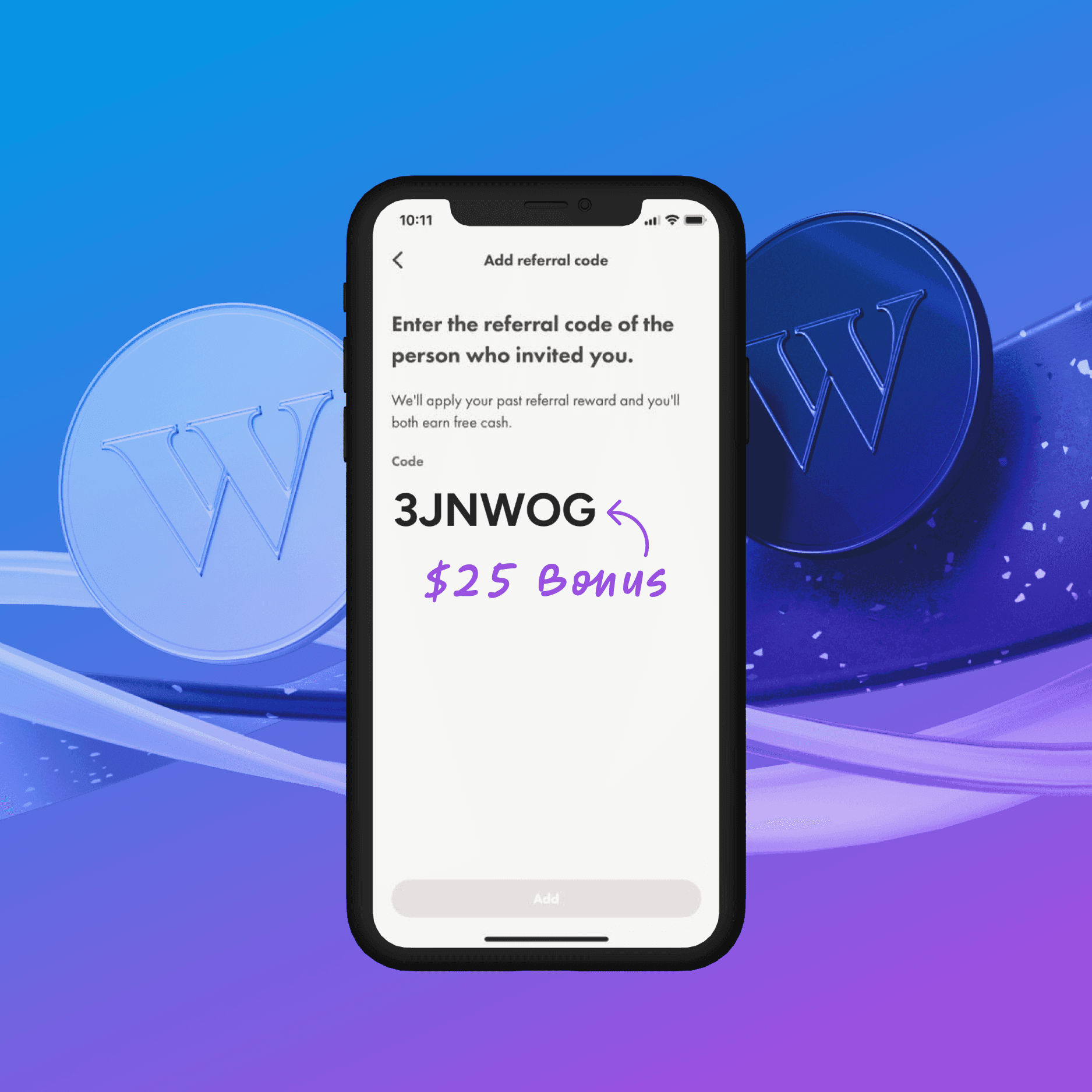

Apps like wealthsimple make automating these investments incredibly easy.

Wealth can be very simple

I use WealthSimple for all my investments because it’s the most user-friendly and intuitive investing app for beginners & advanced investors alike. It offers commission-free trading & cash accounts with an awesome 2.25% – 3.25% interest rate.

But most importantly, it feels truly human.

$25 free with code:

3JNWOG

Conclusion

Dollar Cost Averaging is a powerful and user-friendly investment strategy that offers numerous benefits, including reducing the impact of market volatility, encouraging consistent investing, reducing emotional decision-making, and simplifying the investment process. By adopting this approach, you can build a more stable and rewarding investment portfolio over time.

So, whether you’re a seasoned investor or just starting your financial journey, consider incorporating Dollar Cost Averaging into your investment strategy. It’s a smart, simple, and effective way to navigate the complexities of the stock market and achieve your long-term financial goals. Happy investing!