Introduction

In today’s financial landscape, finding a high-yield savings account is crucial for maximizing your savings. Wealthsimple Cash offers a compelling option with its 3.25% interest cash accounts. This guide will explore the benefits of this account, compare it with average savings account interest rates at various Canadian banks, and explain how you can use it to build your 3-6 month emergency fund.

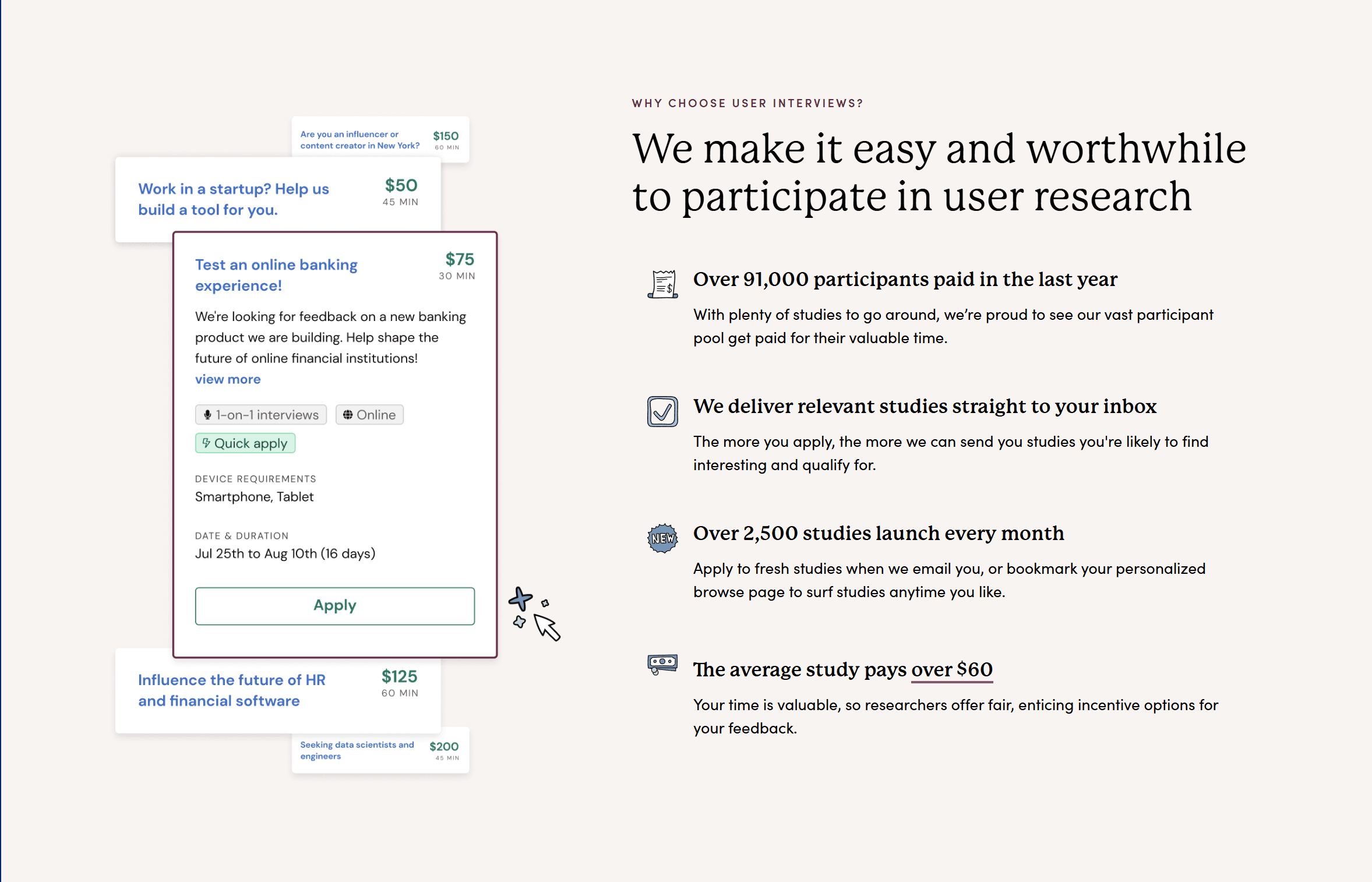

Understanding the Wealthsimple Cash Account

Wealthsimple’s cash account is a high-interest savings account designed to help you grow your money faster. Unlike traditional savings accounts, which often offer lower interest rates, Wealthsimple provides a competitive rate that can significantly enhance your savings over time.

Key Features

- High Interest Rate: At 3.25%, the interest rate is substantially higher than the national average for savings accounts.

- No Fees: Wealthsimple’s cash account comes with no monthly fees, making it a cost-effective option for savers.

- Easy Access: You can easily access your funds whenever you need them, providing flexibility and peace of mind.

Potential for Even Higher Returns

Wealthsimple offers opportunities to increase your interest rate even further. By setting up a direct deposit, you can boost your interest rate to 3.75%. Additionally, if you have over $100,000 in your portfolio, you can enjoy an interest rate of 4.25%. These incentives make Wealthsimple’s cash account not only competitive but also highly rewarding for those who meet the criteria.

Comparison with Average Savings Account Interest Rates

To understand the value of Wealthsimple’s 3.25% cash account, let’s compare it with the average interest rates offered by major Canadian banks:

- RBC Royal Bank: 0.05% – 0.10%

- TD Canada Trust: 0.05% – 0.10%

- Scotiabank: 0.05% – 0.15%

- BMO Bank of Montreal: 0.05% – 0.10%

- CIBC: 0.05% – 0.10%

- As you can see, the interest rates at these traditional banks are significantly lower than Wealthsimple’s 3.25%. This difference can have a substantial impact on your savings growth over time.

Example Calculation

Let’s assume you have $10,000 in a savings account. Here’s how much interest you would earn in one year with different interest rates:

- Wealthsimple (3.25%): $350

- Traditional Bank (0.10%): $10

- The Wealthsimple account would earn you $340 more in interest over the course of a year compared to a traditional bank offering a 0.10% interest rate.

Building Your 3-6 Month Emergency Fund

An emergency fund is a crucial part of financial planning, providing a safety net for unexpected expenses or financial hardships. Financial experts recommend having 3-6 months’ worth of living expenses saved in an easily accessible account.

Steps to Build Your Emergency Fund with Wealthsimple

- Determine Your Monthly Expenses: Calculate your essential monthly expenses, including rent/mortgage, utilities, groceries, transportation, and insurance.

- Set Your Savings Goal: Multiply your monthly expenses by 3 to 6 to determine your emergency fund target.

- Open a Wealthsimple Cash Account: Sign up for a Wealthsimple cash account to take advantage of the 3.25% interest rate.

- Automate Your Savings: Set up automatic transfers from your primary bank account to your Wealthsimple cash account to ensure consistent contributions.

- Monitor Your Progress: Regularly check your account balance and adjust your savings plan as needed to stay on track.

Example Scenario

Suppose your monthly expenses are $2,000. To build a 3-month emergency fund, you would need $6,000. With Wealthsimple’s 3.25% interest rate, your savings would grow faster compared to a traditional bank account, helping you reach your goal more efficiently.

Wealth can be very simple

I use WealthSimple for all my investments because it’s the most user-friendly and intuitive investing app for beginners & advanced investors alike. It offers commission-free trading & cash accounts with an awesome 2.25% – 3.25% interest rate.

But most importantly, it feels truly human.

$25 free with code:

3JNWOG

Conclusion

Wealthsimple’s 3.25% cash account offers a significant advantage over traditional savings accounts with its high interest rate, no fees, and easy access to funds. By leveraging this account, you can effectively build and grow your 3-6 month emergency fund, ensuring financial security and peace of mind. Start maximizing your savings today with Wealthsimple.