In today’s dynamic financial landscape, investors are constantly seeking the best avenues to grow their wealth. While the allure of cryptocurrencies and individual stocks can be tempting, Exchange-Traded Funds (ETFs) such as XEQT, VEQT, and VFV offer a compelling alternative. This article delves into the numerous benefits of investing in these ETFs compared to the volatile world of crypto and the unpredictable nature of individual stocks.

Diversification and Risk Management

Broad Market Exposure

ETFs like XEQT, VEQT, and VFV provide investors with exposure to a broad range of assets. XEQT (iShares Core Equity ETF Portfolio) and VEQT (Vanguard All-Equity ETF Portfolio) offer diversified portfolios that include a mix of Canadian, U.S., and international equities. VFV (Vanguard S&P 500 Index ETF) focuses on the top 500 companies in the U.S. stock market. This diversification helps mitigate the risk associated with investing in a single asset or sector.

Reduced Volatility

Cryptocurrencies are notorious for their extreme volatility. The value of digital currencies can swing wildly within a short period, making them a high-risk investment. In contrast, ETFs tend to be more stable due to their diversified nature. By spreading investments across multiple assets, ETFs like XEQT, VEQT, and VFV reduce the impact of any single asset’s poor performance on the overall portfolio.

Cost Efficiency

Lower Expense Ratios

One of the significant advantages of ETFs is their cost efficiency. ETFs generally have lower expense ratios compared to mutual funds and actively managed portfolios. For instance, XEQT, VEQT, and VFV have competitive management fees, making them an attractive option for cost-conscious investors. Lower fees mean more of your money is working for you, rather than being eaten up by management costs.

No Need for Frequent Trading

Investing in individual stocks often requires active management and frequent trading to capitalize on market movements. This can lead to higher transaction costs and potential tax implications. ETFs, on the other hand, are designed for long-term holding, reducing the need for constant buying and selling. This passive investment strategy not only saves on transaction costs but also aligns with a long-term wealth-building approach.

Accessibility and Convenience

Easy to Buy and Sell

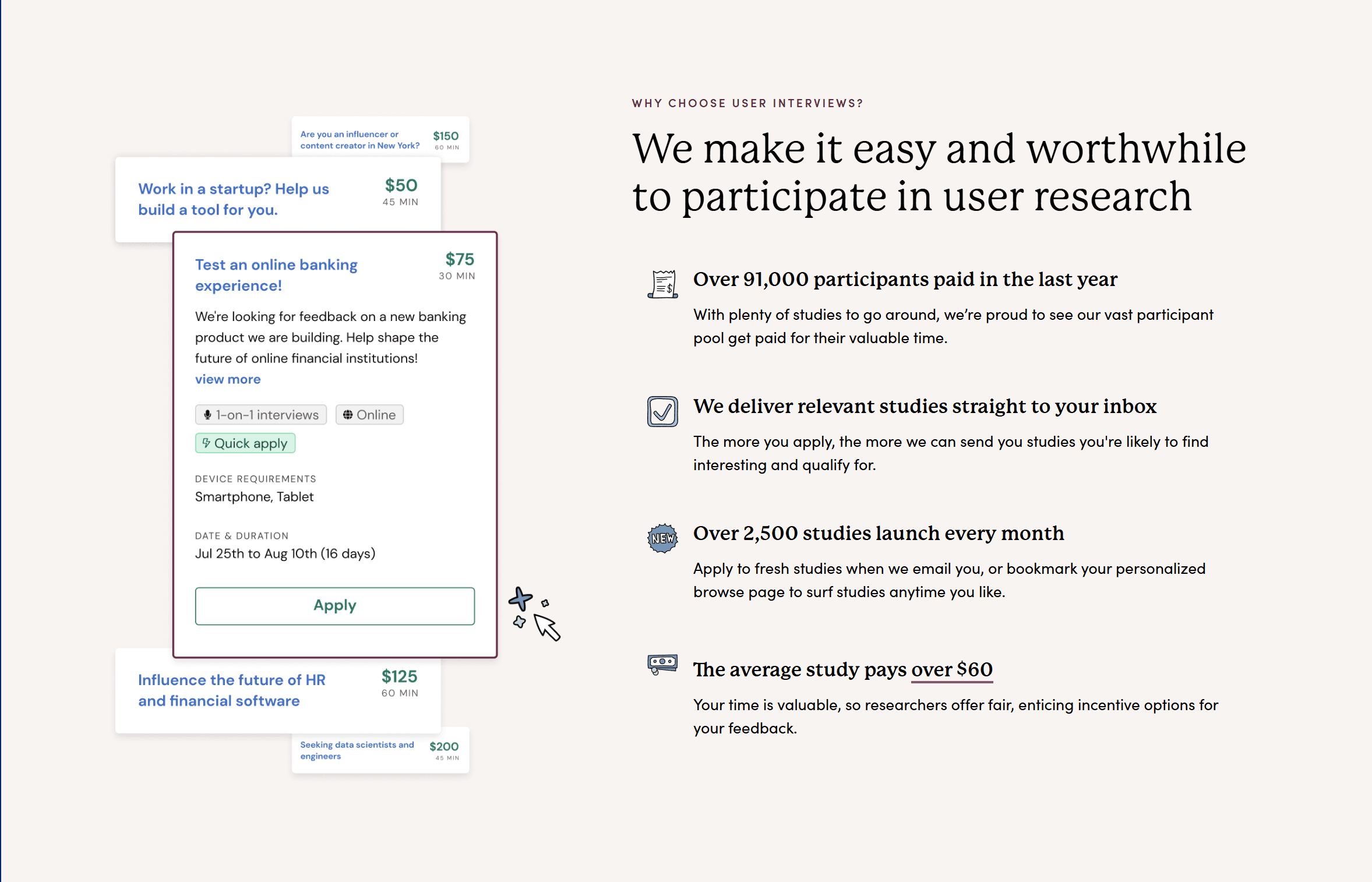

ETFs are traded on major stock exchanges, making them as easy to buy and sell as individual stocks. This liquidity ensures that investors can enter and exit positions with ease. Unlike some cryptocurrencies, which may require specific platforms and wallets, ETFs can be traded through any standard brokerage account.

Simplified Investment Process

Investing in ETFs like XEQT, VEQT, and VFV simplifies the investment process. Instead of spending time researching and selecting individual stocks or navigating the complexities of the crypto market, investors can achieve broad market exposure with a single purchase. This convenience is particularly beneficial for novice investors or those with limited time to manage their portfolios.

Long-Term Growth Potential

Historical Performance

ETFs that track major indices, such as VFV which follows the S&P 500, have historically provided strong long-term returns. The S&P 500, for example, has averaged an annual return of around 10% over the past several decades. While past performance is not indicative of future results, the historical data suggests that ETFs can be a reliable vehicle for long-term growth.

Reinvestment Opportunities

Many ETFs offer dividend reinvestment plans (DRIPs), allowing investors to automatically reinvest dividends to purchase additional shares. This compounding effect can significantly enhance the growth potential of an investment over time. By reinvesting dividends, investors can take advantage of the power of compounding, further boosting their returns.

Wealth can be very simple

I use WealthSimple for all my investments because it’s the most user-friendly and intuitive investing app for beginners & advanced investors alike. It offers commission-free trading & cash accounts with an awesome 2.25% – 3.25% interest rate.

But most importantly, it feels truly human.

$25 free with code:

3JNWOG

Conclusion

While cryptocurrencies and individual stocks have their place in the investment world, ETFs like XEQT, VEQT, and VFV offer a balanced, cost-effective, and convenient alternative. Their diversified nature, lower volatility, cost efficiency, and long-term growth potential make them an attractive option for investors seeking to build wealth steadily over time. By choosing ETFs, investors can enjoy the benefits of broad market exposure without the need for constant management and the high risks associated with more volatile investments.